In today’s rapidly evolving technological landscape, advanced semiconductors play a pivotal role in driving innovation across various industries, enabling the functionality of devices ranging from smartphones to sophisticated healthcare equipment.

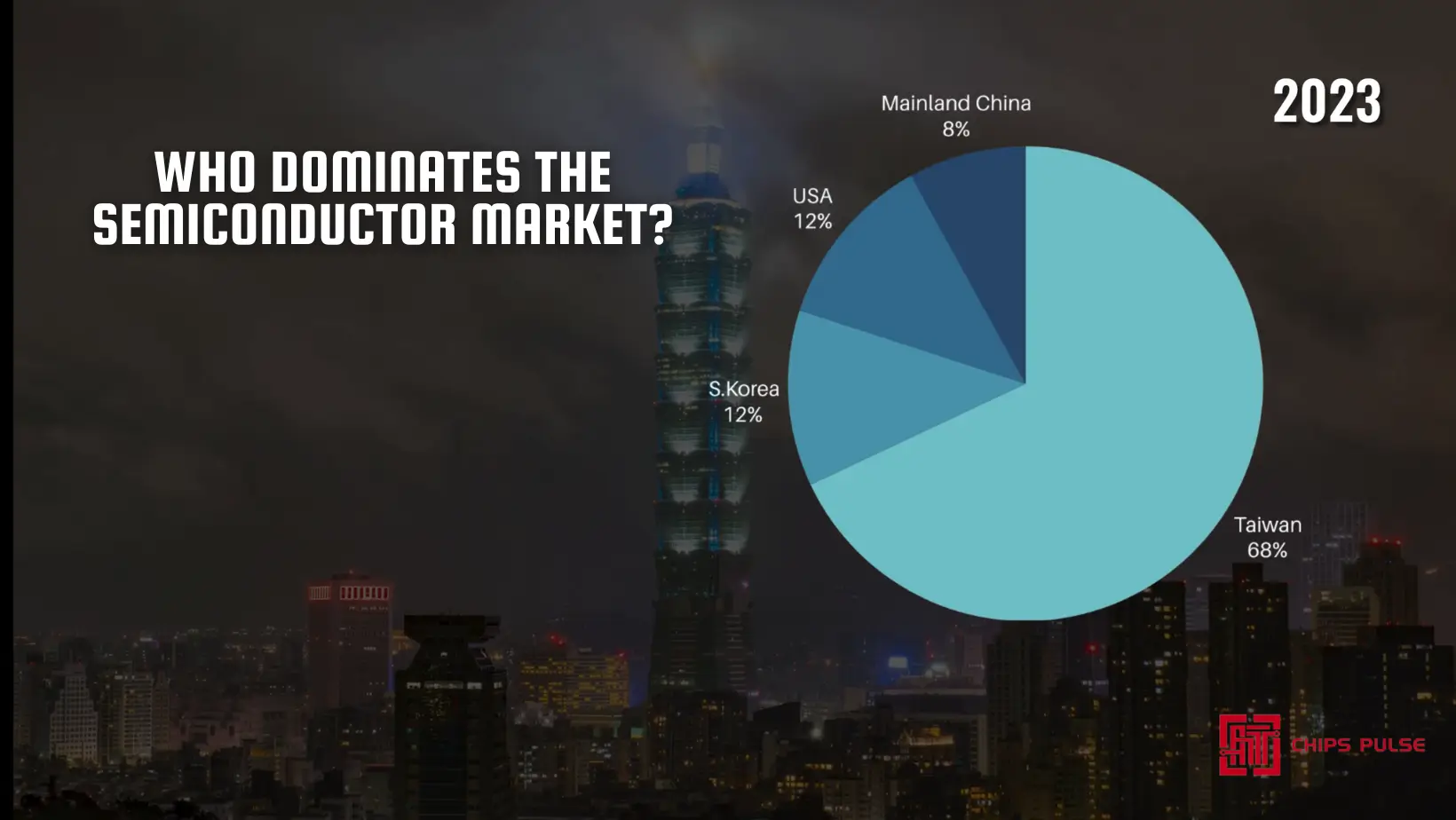

Taiwan leads the way in the advanced semiconductor market, currently accounting for a substantial 68% of the global advanced foundry capacity. However, projections indicate that this share is likely to decrease to 60% by 2027 due to the United States' efforts to enhance its domestic capacity. Notably, Taiwanese semiconductor giant TSMC stands out as the largest producer of advanced semiconductors, garnering a remarkable 60% (approximately $17 billion) of semiconductor foundry revenue in the first quarter of 2023.

The United States is poised to bolster its share of advanced semiconductor process capacity, with expectations set to increase from the current 12% to 17% by 2027. Notably, a significant portion of this capacity growth will be attributed to foreign companies, such as Samsung and TSMC, operating within the U.S. market. This trend highlights a strategic approach to leverage foreign expertise and investment to strengthen domestic semiconductor capabilities.

In response to export controls on advanced chip-making equipment imposed by the U.S., China has strategically pivoted towards focusing on mature semiconductor processes. As a result, China's mature process capacity is anticipated to experience notable growth, escalating from 31% to 39% by 2027. This strategic shift underscores China's adaptability and resilience amidst evolving geopolitical dynamics in the semiconductor industry.

As the competition intensifies and global dynamics continue to evolve, the advanced semiconductor market by country is witnessing significant transformations. The strategic moves by key players are reshaping the competitive landscape, setting the stage for a dynamic and fiercely competitive future in the semiconductor industry.